Have you ever found a puzzling “PNP Bill Payment” on your bank statement? Did it send your financial peace into disarray? Is it a legitimate service or a lurking hidden fee, poised to pounce on your hard-earned cash?

Here at Cat-Us.com, we understand the feline fear of the unknown.

In this post, I’ll embark on a quest to demystify the “PNP Bill Payment.” We’ll delve into its legitimacy, explore its uses, and equip you with the knowledge to handle any potential disputes.

So, sharpen your claws (figuratively, of course). Prepare to change from a bewildered bystander to a master of your financial jungle!

Plug’n Pay (PNP) acts as a trustworthy payment processing system. Many organizations, such as municipalities and businesses, use it. It’s used to handle your credit card and electronic check payments securely. It ensures your financial information remains safe while streamlining the bill payment process, making it a convenient friend for both you and the biller.

What is PNP Bill Payment charge on Bank Statement?

PNP Bill Payment is a legitimate charge that appears when you make online payments to businesses or municipalities using the Plug’n Pay processing system. Think of it as a secure middleman that handles your credit card or electronic check information.

It’s an online payment system that allows organizations like local governments, utilities, and other businesses to securely accept credit card and electronic check payments from customers.

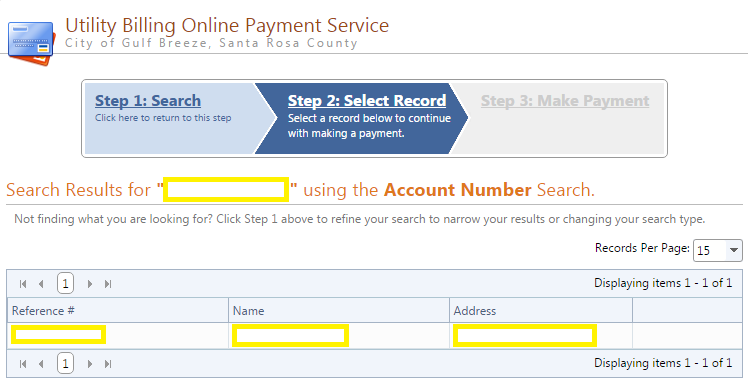

When you make an online payment to one of these entities, the charge will show up on your bank statement as “PNP BILLPAYMENT”.

Some common examples of payments that may appear are:

- Utility bills (water, electricity, etc.)

- Property taxes

- Rent payments

- License and permit fees

- Sewage charges

Overall, it is a standard descriptor used to indicate an online payment made through the Plug’n Pay system.

Hidden Fees:

Are there any hidden fees associated with PNP Bill Payment?

In my experience helping clients navigate their finances, I’ve come across the “Bill Payment” charge on bank statements quite a bit.

Here’s what I’ve learned:

Potential for Hidden Fees?

While PNP itself seems straightforward, a few things raise eyebrows. Some users report unexpectedly high PNP charges, like one case with an $11,000 fee. This suggests the possibility of hidden fees lurking within the system. Additionally, some sources claim the processing fee might not always be displayed upfront, creating a “hidden fee” situation.

My Advice: Be Vigilant

Here’s what I recommend:

- Scrutinize Your Statements: Carefully review any PNP Bill Payment charges, comparing them to recent payments. Are the fees what you expected?

- Investigate Discrepancies: If you see unexpected or high charges, don’t hesitate to contact your bank and the organization you paid. Investigate further to understand the discrepancy.

The Bottom Line:

PNP Bill Payment is generally legitimate, but the potential for hidden fees within the system exists. Be vigilant when reviewing your statements, and don’t be afraid to question unexpected charges.

Legitimate: Is it Safe?

How can I verify if a PNP Bill Payment charge is legitimate?

In my line of work, I often see clients confused by “PNP Bill Payment” charges on their statements. Here are some steps I recommend to determine if a charge is legitimate:

Digging into Your Bank Statement:

First things first, become a financial detective. Scrutinize your bank statement for any unusual or unfamiliar PNP charges. Are there payments you can’t readily recall making?

Calling Your Bank for Backup:

Next, pick up the phone and reach out to your bank’s customer service. They can access detailed information about the charge and confirm its origin. Think of them as your financial partner in this investigation.

Following the Paper Trail:

Don’t forget the power of digital receipts! Review your emails for any invoices or receipts related to the charge. These can often shed light on the purpose of the payment.

Going Straight to the Source:

If the paper trail remains unclear, take a proactive approach. Contact the company or municipality that you believe might have initiated the payment. A quick phone call or email can often clear up any confusion.

Filing a Dispute if Needed:

In the rare case where you still can’t verify the charge or believe it’s unauthorized, you have the option to file a dispute with your bank. They will then investigate the matter on your behalf.

By following these steps, you can effectively navigate the world of PNP Bill Payments and ensure only legitimate charges grace your bank statement. Remember, vigilance is key!

Uses & Disputes

The beauty of PNP lies in its versatility. Here’s a glimpse into the wide range of payments it facilitates:

- Municipal Payments: Imagine paying your water bill, property taxes, or even pet license fees – all conveniently through PNP.

- Business Payments: Streamline your finances by using this for rent, utility bills, membership fees, or even recurring subscriptions.

- Government Payments: Traffic tickets, property taxes, or stormwater bills – PNP handles them all efficiently.

- E-commerce Transactions: Online shopping carts, digital downloads, or subscription services – PNP ensures a smooth checkout experience.

- Point-of-Sale Transactions: It facilitates in-store credit card processing and even electronic check transactions.

- Recurring Payments: Never miss a beat with automated payments for subscriptions, memberships, utilities, or even insurance premiums.

Can I set up recurring payments through Plug’n Pay?

In my experience helping businesses manage payments, a common question revolves around recurring billing. Did you know that Plug’n Pay (PNP) offers a user-friendly solution? Here’s how to unlock its potential:

1. Becoming a PNP Insider:

First things first, head over to the Plug’n Pay website and create an account. Think of it as your gateway to a world of automated payments.

2. Taking Control with Settings:

Once you’re logged in, navigate to the “Settings” section. This is where the magic happens – you’ll find a dedicated area for recurring billing.

"Settings" > "Recurring Administration" 3. Automating Your Revenue:

Dive into the “Recurring Administration” section. Here, you can configure recurring payments for your customers, ensuring a steady stream of income. No more chasing down late payments!

4. Boosting Efficiency:

For e-commerce businesses, listen up! It is seamlessly integrates with platforms like AmeriCommerce. This allows you to manage all your recurring payments within a familiar interface, maximizing efficiency.

5. Testing: The Final Step

Before unleashing the power of recurring payments, it’s crucial to test your setup. Make a test payment to ensure everything works smoothly. This gives you peace of mind and avoids any hiccups down the line.

By following these steps, you can utilize PNP’s recurring payment feature to manage your customer transactions effortlessly. It’s a win-win for both you and your customers!

Benefits:

what are the benefits of using Plug’n Pay for online payments?

In today’s digital world, seamless and secure online payments are crucial for businesses. Here’s why Plug-n-Pay (PNP) has caught my eye as a payment processing solution:

- Secure Your Transactions: Security is paramount! PNP prioritizes a secure environment for both credit card and electronic check transactions. Think of it like a digital vault protecting your customers’ financial information.

- Effortless Payment Management: PNP’s “plug-in” technology lives up to its name. It simplifies integration, allowing merchants to manage all their payments – credit cards and electronic checks – from one central location. No more juggling multiple systems!

- Cost Savings: There’s nothing better than saving money, right? Plug’n Pay claims to offer “zero cost payment solutions”, allowing merchants to accept credit card payments at 0% cost. This can help businesses improve their cash flow and overall financial health by reducing the costs associated with payment processing.

- Flexibility is Key: When it comes to payment methods, PNP caters to diverse needs. They support credit cards, electronic checks, and even recurring billing options, giving your customers the freedom to choose how they pay.

- Integration Made Easy: Don’t worry if you already have other systems in place. PNP integrates seamlessly with various e-commerce platforms, accounting software, and point-of-sale systems. It’s like adding a plug to an outlet – simple and efficient.

- Compliance Confidence: Regulations can be tricky. PNP helps merchants navigate compliance complexities by ensuring adherence to industry standards. This reduces the risk of penalties and legal headaches, giving you peace of mind.

- Expanded Reach: The world is your oyster! PNP supports payments in multiple currencies. This opens doors to a wider customer base, allowing you to tap into international markets.

The Takeaway:

Based on my experience, Plug-n-Pay emerges as a strong contender for businesses seeking a comprehensive and secure payment processing solution. It offers a combination of security, streamlined management, potential cost savings, and flexibility, ultimately leading to a smoother payment experience for both you and your customers. As always, it’s wise to research and compare different options before making a decision.

Disputes OR Refunds:

How does Plug’n Pay handle disputes or refunds?

In the world of online payments, Plug-n-Pay (PNP) is a common player. But what happens if you encounter a problem with a PNP transaction? Here’s a breakdown to help you navigate disputes and refunds:

Disputes with PNP:

- Formal Process: It has a formal dispute resolution process through arbitration. This means a neutral third party settles disagreements – think of it like a judge, but in the world of finance.

- The Catch: While arbitration sounds official, it can be time-consuming and potentially costly. This route might not be ideal for smaller disputes.

Refunds from PNP:

- Limited Scope: The information on PNP refunds is a bit unclear. They do offer refunds for unused portions of your account upon cancellation, but what about disputed transactions?

- Missing Details: Unfortunately, there aren’t clear instructions on how to request a refund directly from PNP.

The Merchant’s Role:

- Merchant Responsibility: As a payment processor, It works with businesses (think online stores or municipalities). These businesses likely have their own refund policies.

- Check First: Before jumping into disputes, always check the refund policy of the merchant you paid through this. They might be able to resolve the issue more quickly.

The Bottom Line:

- Unclear Process: The process for disputes and refunds with PNP itself isn’t readily apparent.

- Focus on Merchants: If you have an issue with a PNP transaction, it’s best to start by contacting the merchant you paid. They might have a simpler resolution process.

- Weigh the Options: If the merchant can’t help and you believe the issue lies with PNP, consider the potential cost of arbitration compared to the disputed amount.

Remember: Knowledge is key when it comes to your finances. By understanding how PNP operates, you can navigate disputes and refunds more effectively.

What i do not understood is in truth how you are not actually a lot more smartlyliked than you may be now You are very intelligent You realize therefore significantly in the case of this topic produced me individually imagine it from numerous numerous angles Its like men and women dont seem to be fascinated until it is one thing to do with Woman gaga Your own stuffs nice All the time care for it up

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do so Your writing taste has been amazed me Thanks quite nice post

Thanks I have just been looking for information about this subject for a long time and yours is the best Ive discovered till now However what in regards to the bottom line Are you certain in regards to the supply

you are in reality a just right webmaster The site loading velocity is incredible It seems that you are doing any unique trick In addition The contents are masterwork you have performed a wonderful task on this topic

Fantastic beat I would like to apprentice while you amend your web site how could i subscribe for a blog site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear concept

Thanks I have recently been looking for info about this subject for a while and yours is the greatest I have discovered so far However what in regards to the bottom line Are you certain in regards to the supply

We absolutely love your blog and find many of your post’s to be

exactly what I’m looking for. can you offer guest writers to write content for you personally?

I wouldn’t mind composing a post or elaborating on a few of the subjects you

write concerning here. Again, awesome web log!

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but instead of that this is excellent blog A fantastic read Ill certainly be back