The WUVISAAFT charge on your bank statement might seem strange at first. Is it important? Should you pay more attention to it? We will look into where this charge comes from and why it shows on your bank statement.

Key Takeaways:

- The WUVISAAFT charge refers to the Western Union Visa Acquirer Fee Transaction.

- Western Union is a trusted money transfer service for sending and receiving money globally.

- The charge represents the fee incurred by Western Union from Visa for processing transactions on your Visa card.

- This fee is legitimate and disclosed in Western Union’s terms and conditions.

- Understanding the WUVISAAFT charge helps you make informed decisions regarding your transactions.

What is the WUVISAAFT Charge?

The WUVISAAFT charge is from Western Union Visa Acquirer Fee Transaction. This fee is for using Western Union, a popular service for global money transfers.

When you use your Visa card at Western Union, Visa charges them a handling fee. That’s what the WUVISAAFT charge covers, which then shows on your statement. So, you see this charge if you used your Visa card at Western Union.

Finding the WUVISAAFT charge on your bank statement means you used your Visa at Western Union.

Why is the WUVISAAFT charge legitimate?

The WUVISAAFT charge is a legitimate fee passed on to customers when they make transactions through Western Union using their Visa cards.

The WUVISAAFT charge is mentioned in Western Union’s rules. So, it’s not a hidden fee by your bank or Western Union. It’s openly part of using your Visa at Western Union.

Knowing about the WUVISAAFT charge helps people read their bank statements clearly. This reduces confusion or worry about the fee.

Why Does Western Union Charge This Fee?

Western Union adds the WUVISAAFT fee for a few key reasons:

- Costs of moving money. With agents and partners everywhere, Western Union needs a lot of tech and infrastructure. They use this fee to keep their systems working well.

- Connections around the world. Operating in lots of countries means dealing with various currencies. They use this fee to improve their compliance and security, making sure everything runs smoothly.

- Changing currencies. When money goes from one country to another, it must be converted. Handling these conversions can be expensive. By charging the WUVISAAFT fee, Western Union can keep their prices fair.

- Security. They spend a lot to keep customers’ money and information safe. With the WUVISAAFT charge, they can invest in the latest tech and compliance, protecting your transfers.

This charge is crucial for Western Union’s global service. It shows their dedication to a strong, safe, and reliable money transfer system. The fee goes into making sure they can continue to serve you well.

Variation of the WUVISAAFT Charge

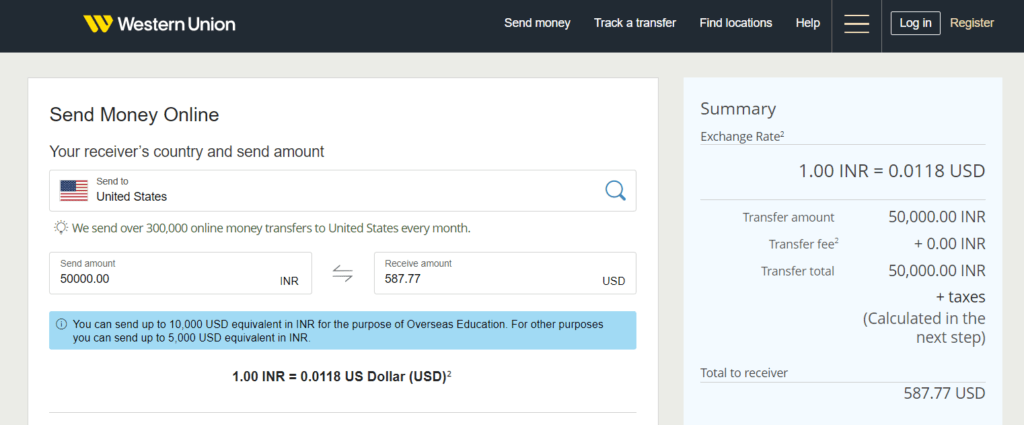

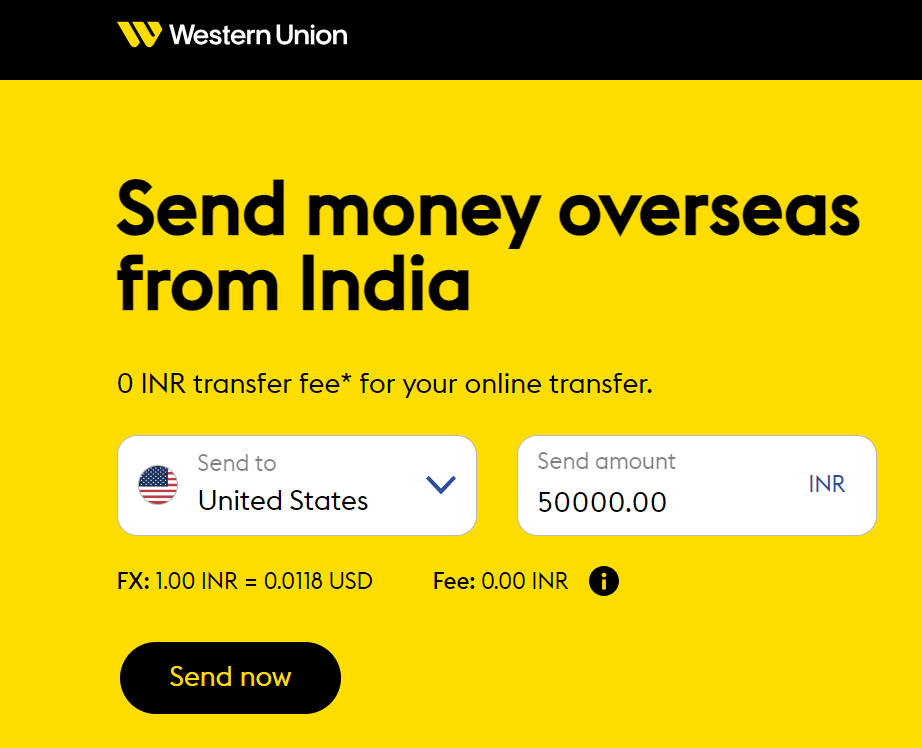

The WUVISAAFT charge may vary depending on factors such as the amount of the transaction and the country it is being sent to.

The WUVISAAFT charge can change based on different reasons. For example, it can depend on the amount of the transaction and where the money is going.

Typically, this charge is between $0.50 to $10. The charge is usually about 1% of the total money you’re sending. Western Union says this on their website.

When you use your Visa card with Western Union, they look at your transaction details. Then, they calculate the fee to match the costs they have to process the transfer.

For instance, if you send $500 to someone in another country, the charge could be about $5. Just remember, this fee might change a bit depending on your specific transaction details.

The change in the WUVISAAFT cost tries to match what it costs Western Union. This is for handling different transaction amounts and sending to various countries.

Knowing about the changing WUVISAAFT charge helps you plan your transfer expenses with Western Union. By checking the fees before sending money, you can avoid surprises in your bill.

Understanding the range of WUVISAAFT charges can help you manage your money transfers wisely. This way, you know what to expect in terms of fees when sending money worldwide.

Can the WUVISAAFT Charge Be Avoided?

Unfortunately, you can’t dodge the WUVISAAFT charge using Western Union with your Visa card. But, you can try alternative methods to skip this fee. For example, consider making a bank transfer or pay with cash. Each of these options might have its own fees. Always check with your bank or payment provider for details on extra charges.

Even though avoiding the WUVISAAFT charge directly might be tough, knowing other ways to pay can give you options.

Let’s look at different payment methods and what fees they might have:

| Payment Method | Fees |

|---|---|

| Visa Card | WUVISAAFT charge |

| Bank Transfer | Depends on your bank |

| Cash | Depends on your location |

The table shows that a bank transfer or cash payment could work without the WUVISAAFT charge. Still, think about convenience, how fast the money goes through, and if it’s available where you are.

Always compare the possible fees from different payment ways with the WUVISAAFT charge. This way, you can pick the best way that saves you money. Also, read the rules of your chosen method to avoid any surprises.

Refundability of the WUVISAAFT Charge

Usually, the WUVISAAFT charge can’t be refunded. But, if there’s a mistake in a transaction or double charges happen, Western Union will help. They have a customer service team ready to look into these cases.

If you think there’s been a mistake or you were charged twice for the WUVISAAFT, contact Western Union as soon as possible. They’ll help you start the refund process and solve the problem.

The chance of getting a refund depends on what went wrong in the transaction. The Western Union team will check your case and tell you if you’re eligible for a refund.

When reaching out to Western Union, make sure you have all the transaction details. Things like the date, amount, and reference number are important. This info helps the customer service representative handle your case faster.

Remember, getting a refund isn’t always possible because of the WUVISAAFT charge. Western Union follows its own refund rules, which change depending on the situation. They aim to handle your concern fairly and clearly.

Western Union Refund Policy Example

| Refund Request Type | Refund Eligibility | Refund Process |

|---|---|---|

| Error in Transaction | Eligible for refund if the error can be verified | Review and investigation by customer service team |

| Duplicate Charges | Eligible for refund if duplicate charges are confirmed | Review, investigation, and adjustment of charges by customer service team |

| Other Circumstances | Case-by-case evaluation | Review, investigation, and decision by customer service team |

Each refund policy can change, so it’s good to check Western Union’s official policy. You can also contact their customer service for the latest details on refunds.

What are Unrecognizable WUVISAAFT Charges?

See a strange WUVISAAFT charge on your bank statement or can’t remember using Western Union? It’s important to act fast. Call your bank and Western Union’s customer service right away. They will look into the charge and check if it’s valid. Taking quick action protects your account’s safety and helps solve any possible errors or fraud.

Not recognizing a WUVISAAFT charge sometimes means it’s a mistake or fraud. Contact your bank and Western Union quickly. They’ll confirm if the charge is real. This quick action defends your money from possible wrong charges. Plus, it solves the problem faster and stops more issues from coming up.

Square Charges vs. WUVISAAFT Charges

Looking at your bank statement, you might see different payment processing charges. Two common ones are Square fees and WUVISAAFT charges. They help process electronic payments but serve different needs.

| Square Charges | WUVISAAFT Charges |

|---|---|

| Associated with Square, a payment processing service | Associated with Western Union, a money transfer service |

| For transactions through Square’s platform | For transactions at Western Union with a Visa card |

| Works for both in-person and online payments | Only for money transfers |

| Helps businesses and regular folk | Makes global money transfers possible |

Tips to Avoid WUVISAAFT Charges

To stay clear of WUVISAAFT charges, take some key steps. These methods can help you avoid extra fees. They also make sending and receiving money hassle-free.

1. Plan Your Money Transfers:

- Don’t Wing It: Budget for Your Transfers: Think of those charges like surprise guests at a party. They might be fun (if you planned for them!), but unexpected ones can crash your financial budget. Here’s the key: budget for any Western Union transfers you have coming up. Treat them like any other bill – plan ahead and factor them into your spending plan.

- Know Your Options: The world of money transfers is vast! While WUVISAAFT might be your go-to, there are other options. Consider bank transfers, which can often be faster and cheaper, especially for domestic transactions. There are also money transfer services with clear, upfront fees, so you know exactly what you’re paying for. Do some research and see if there’s a better fit for your needs!

2. Smart Banking Practices to Minimize Fees

Everybody wants to reduce how much they spend on transferring. If you use smart practices, you can cut down on fees and save money in the end. You can use Auto Sweep FD and other facilities to pay your WUVISAAFT Charges by their interest, I think it’s a smart move.

3. Set up Mobile Alerts and Automate Bill Payments

Start by setting up mobile alerts for your bank account. This is great for keeping track of your money and avoiding surprise fees. Also, set your bills to pay automatically. This way, you won’t have to worry about late payments and the fees they bring.

4. Regularly Review Bank Statements

It’s important to check your bank statements often. This helps you catch any wrong fees or charges early. Then, you can fix them before they become a bigger problem.

5. Create a Comprehensive Budget and Establish an Emergency Fund

Making a detailed budget is key to money management. It lets you see where you’re spending too much and where you can save. A good budget also stops you from overspending and getting hit with fees. Also, having an emergency fund helps you handle unexpected costs without extra fees.

6. Consider Overdraft Protection and Negotiate with Your Bank

Overdraft protection could be a helpful service to avoid extra bank fees. Plus, don’t forget you can talk to your bank about the fees. They might lower or waive some, based on your situation.

By making smart choices, you can keep your money safe. And you’ll avoid fees that you don’t need to pay.

Conclusion

In conclusion, if you see a charge called WUVISAAFT on your bank statement, it’s okay. It’s a real fee for using Western Union services with your Visa card. The fee is openly shared by Western Union in their terms and conditions. It helps with the costs of processing transactions and keeps their global services running.

It’s good to know why the WUVISAAFT charge is there. It’s not a trick or fake charge but a true cost from Western Union. If you’re unsure about this charge, you can always contact Western Union’s customer service for help.

Always check your bank statements and learn about different fees for sending money. Staying on top of your financial details helps you manage your money better. It also protects you from unexpected costs.

Just wish to say your article is as surprising The clearness in your post is just cool and i could assume youre an expert on this subject Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post Thanks a million and please keep up the enjoyable work

Somebody essentially lend a hand to make significantly posts I might state That is the very first time I frequented your web page and up to now I surprised with the research you made to create this particular put up amazing Excellent job

I do trust all the ideas you’ve presented in your post. They are really convincing and will definitely work. Nonetheless, the posts are too short for newbies. May just you please lengthen them a bit from next time? Thank you for the post.

Thanks I have just been looking for information about this subject for a long time and yours is the best Ive discovered till now However what in regards to the bottom line Are you certain in regards to the supply

Fantastic beat I would like to apprentice while you amend your web site how could i subscribe for a blog site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear concept

Simply wish to say your article is as amazing The clearness in your post is just nice and i could assume youre an expert on this subject Well with your permission let me to grab your feed to keep updated with forthcoming post Thanks a million and please carry on the gratifying work

Hi Neat post Theres an issue together with your web site in internet explorer may test this IE still is the marketplace chief and a good component of people will pass over your fantastic writing due to this problem